Theta Decay.

Theta decay, also known as time decay or simply “theta,” is a critical concept in option trading. It refers to the rate at which the value of an option erodes as time passes, assuming all other factors remain constant. Theta decay is a fundamental aspect of options pricing and plays a significant role in determining an option’s price, particularly in the context of time-sensitive strategies. In this comprehensive discussion, I will provide a detailed explanation of theta decay, its significance in option trading, how it is calculated, and how traders can use this concept to their advantage.

Table of contents.

1. Introduction to Option Trading.

2. Basics of Options.

3. Option Pricing Factors.

4. Understanding Theta Decay.

5. Significance of Theta Decay.

6. Factors Influencing Theta Decay.

7. Calculating Theta.

8. Time Decay Strategies.

9. Conclusion.

Introduction to Option Trading.

Option trading is a financial instrument that provides investors with the opportunity to profit from the movement of underlying assets without actually owning those assets. It is a versatile tool used by traders and investors for various purposes, including speculation, hedging, and income generation. Options come in two main forms: calls and puts.

• Call Option : These give the holder the right, but not the obligation, to buy an underlying asset at a predetermined price (strike price) before or on a specific expiration date.

• Put Option : These give the holder the right, but not the obligation, to sell an underlying asset at a predetermined price (strike price) before or on a specific expiration date.

Option trading strategies can be classified into two main categories :

• Directional Strategies : These strategies involve betting on the price movement of the underlying asset. They include buying call options if you expect the asset’s price to rise (bullish) and buying put options if you anticipate a price decline (bearish).

• Non-Directional Strategies : These strategies focus on other factors besides the asset’s price, such as volatility, time, or both. Non-directional strategies are often used to generate income or hedge existing positions.

Basics of Options.

To understand theta decay, it’s important to grasp some fundamental concepts related to options:

• Strike Price : The strike price is the price at which the option holder has the right to buy (for call options) or sell (for put options) the underlying asset.

• Premium : The premium is the price that an option buyer pays to acquire the option. It represents the cost of the option and is determined by several factors, including the underlying asset’s price, strike price, time to expiration, and implied volatility.

• Expiration Date : Options have a limited lifespan, with a specified expiration date. Options can be categorized as short-term (e.g., weekly options) or long-term (e.g., LEAPS, which can have expirations up to several years).

• Intrinsic Value and Time Value : An option’s premium can be divided into two components: intrinsic value and time value. Intrinsic value is the portion of the premium that represents the option’s immediate value if it were to be exercised. Time value is the portion of the premium that reflects the potential for the option to gain value over time.

Option Pricing Factors.

Options are priced using various factors, which are often represented by the Black-Scholes-Merton model or more advanced models like the Binomial model. The primary factors that influence option prices are:

• Underlying Asset Price : The current price of the underlying asset has a direct impact on the option premium. For call options, as the asset’s price increases, the option premium generally rises. Conversely, for put options, as the asset’s price decreases, the option premium generally increases.

• Strike Price : The relationship between the strike price and the underlying asset price determines whether an option is in-the-money (ITM), at-the-money (ATM), or out-of-the-money (OTM). Options with strike prices closer to the current asset price typically have higher premiums.

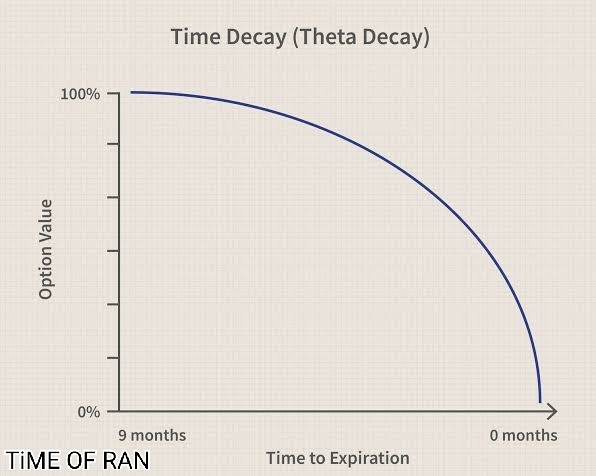

• Time to Expiration : The time until the option’s expiration date plays a crucial role in option pricing. The more time an option has until expiration, the higher its time value. As the expiration date approaches, the time value decreases.

• Implied Volatility : Implied volatility reflects the market’s expectations of future price fluctuations of the underlying asset. Higher implied volatility results in higher option premiums, as it increases the likelihood of the option moving into a profitable position.

• Interest Rates : Interest rates have a minor impact on option pricing. Higher interest rates can slightly increase call option premiums and decrease put option premiums because the cost of holding the option’s cash collateral is higher.

Understanding Theta Decay.

Theta decay, often referred to as just “theta,” is one of the essential factors affecting an option’s premium. It represents the rate at which the option’s time value diminishes as time passes, assuming all other factors (stock price, implied volatility, and interest rates) remain constant. In simple terms, it is the daily erosion of an option’s value due to the passage of time.

Theta decay is a crucial concept for option traders to understand because it can significantly impact the profitability of options positions. Here’s how it works:

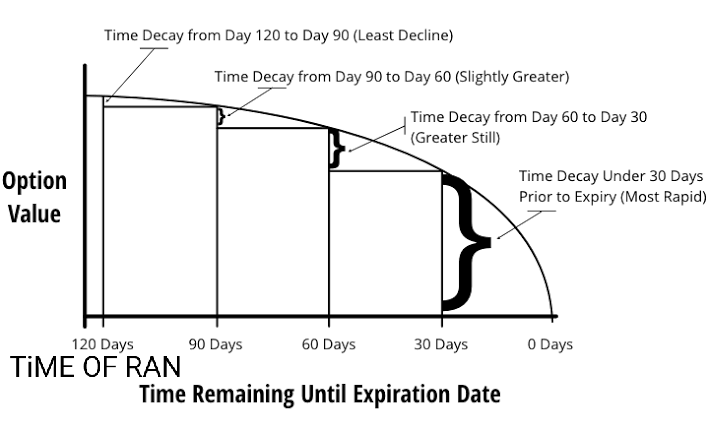

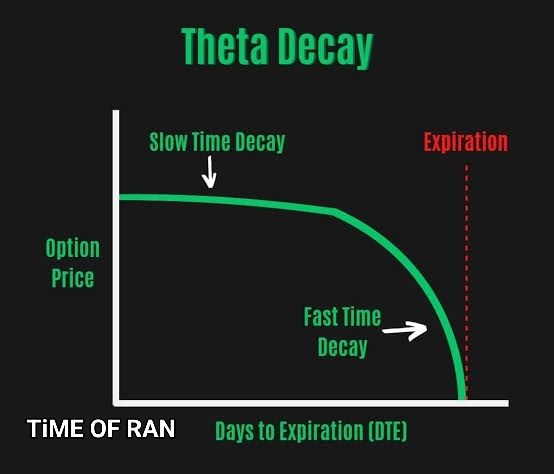

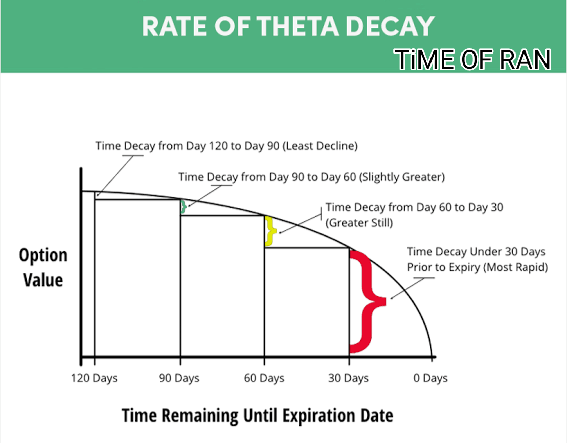

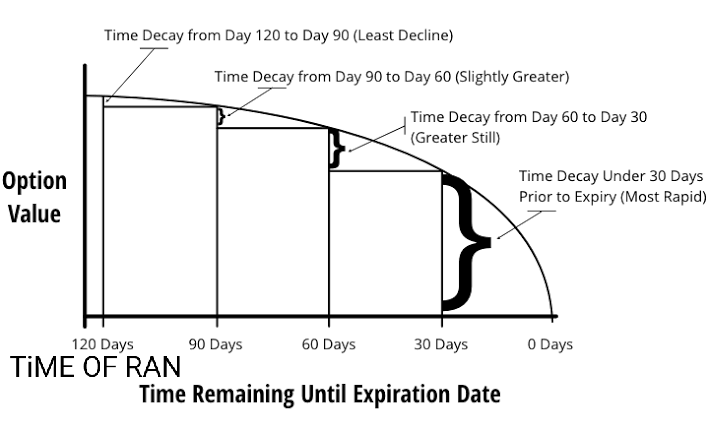

• Time Value Erosion : Options have both intrinsic value (if they are in-the-money) and time value. Theta specifically measures the time value component. As an option’s expiration date approaches, the time value decreases. This erosion in time value accelerates the closer the option gets to expiration.

• Linear Decay : Theta decay is linear in nature. This means that, all else being equal, the daily reduction in an option’s time value is relatively constant, which is essential for option pricing models to work effectively

• Different for Calls and Puts : Theta decay behaves differently for call options and put options. Generally, call options have positive theta, while put options have negative theta. This is because call options benefit from the passage of time, while put options are adversely affected.

• Non-Linear Effects : While theta decay is generally linear, it can exhibit non-linear behavior as the option approaches expiration. The rate of time decay accelerates significantly in the final weeks, days, and hours leading up to expiration.

Significance of Theta Decay.

Theta decay is significant for several reasons in option trading.

• Risk Management : Understanding theta helps traders manage risk. It highlights the cost of holding options positions, particularly when employing strategies like covered calls or cash-secured puts.

• Profit Potential : Theta can also be used strategically to enhance profit potential. For instance, if a trader believes that an option’s time decay will accelerate as it approaches expiration, they may choose to sell options to capitalize on this decay.

• Time-Sensitive Strategies : Many options trading strategies, such as iron condors, calendars, and diagonals, are highly dependent on theta. Traders use these strategies to take advantage of time decay by either being net sellers of options or structuring positions to benefit from the passage of time.

• Income Generation : Theta is a key component of income-generating strategies, such as covered calls and credit spreads. These strategies involve selling options with high time decay to collect premiums and generate consistent income.

• Time Horizon : Theta can influence the choice of expiration dates. Traders with short-term outlooks may prefer options with lower time values, while long-term investors may look to minimize theta by choosing options with more extended expiration dates.